Posted By: Medsole RCM

Posted Date: Feb 17, 2026

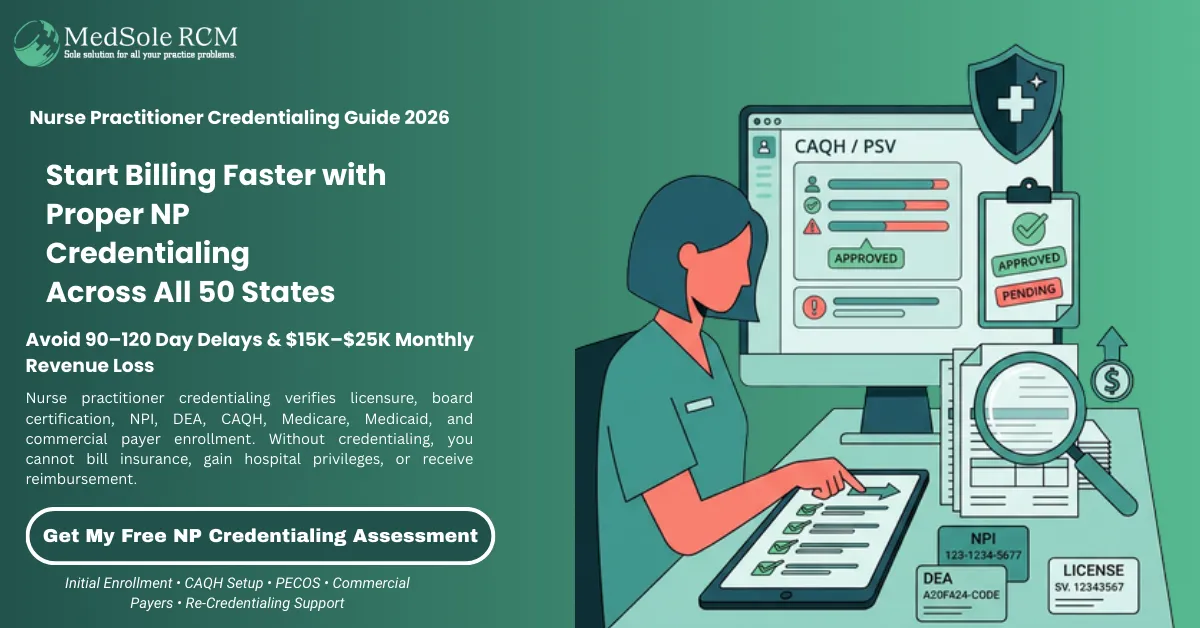

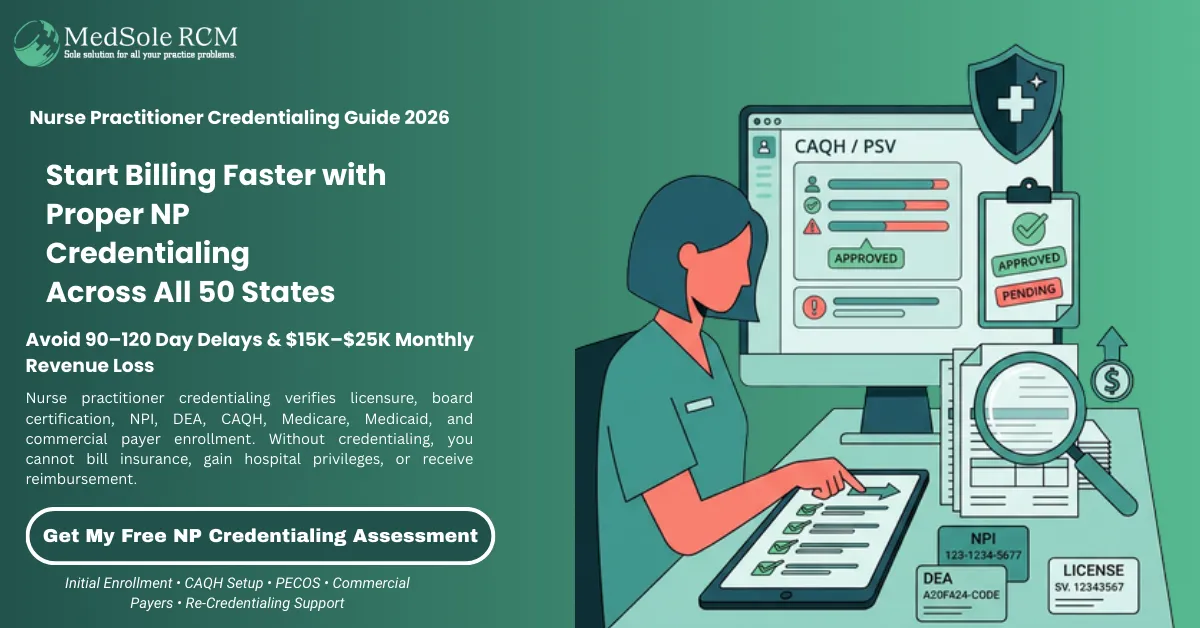

The average nurse practitioner credentialing process takes 90 to 120 days. Every month of delay can cost a practice $15,000 to $25,000 in lost revenue from unbillable services. That's not a minor setback. It's a revenue problem that compounds with every passing week.

Nurse practitioner credentialing is the process of verifying an NP's education, licensure, board certifications, and professional background to ensure they meet the standards required by healthcare organizations, insurance payers, and state regulatory bodies. It enables nurse practitioners to obtain in-network status with insurance companies, gain hospital privileges, and bill independently for clinical services under their own NPI number.

Without credentialing, you can't bill. You can't get reimbursed. Your practice can't grow.

At MedSole RCM, credentialing for nurse practitioners is something our team handles daily. Our provider enrollment and credentialing services support NPs across all 50 states, from first-time applicants to multi-state telehealth providers. This guide covers the full NP credentialing landscape, including 2026 regulatory changes already affecting timelines and application requirements.

In this guide, you'll learn:

Credentialing for nurse practitioners isn't just paperwork. It's the gateway to getting paid, serving more patients, and staying compliant. Delay it or skip it, and the consequences hit fast.

Here's the thing: if you're not credentialed with a payer, you can't bill that payer. Claims submitted under an uncredentialed NP get denied. No exceptions, no workarounds.

Delays in nurse practitioner credentialing translate directly to lost revenue. According to the Medical Group Management Association (MGMA), credentialing delays rank among the top five causes of revenue loss in new practices.

Some NPs try to work around this with incident-to billing, where services get billed under a supervising physician's NPI. It works in limited settings. But it caps your reimbursement, limits your autonomy, and doesn't build your own payer history.

Insurance credentialing for nurse practitioners directly affects how many patients you can see. Without in-network status, patients have to pay the full cost themselves. Most won't.

The market shift from PPO to HMO plans has made this worse. Out-of-network benefits are shrinking across the board. Patients don't just prefer in-network providers anymore. They require them.

Being credentialed with Medicare, Medicaid, Blue Cross Blue Shield, UnitedHealthcare, Aetna, Cigna, and Humana opens your practice to the widest patient base possible. With healthcare costs rising and coverage expanding under the Affordable Care Act, patients expect their providers to accept insurance. If you don't, they'll find someone who does.

NP credentialing isn't optional from a compliance standpoint. Hospital privileging requires it. State Boards of Nursing require background verification. CMS mandates enrollment for Medicare participation. And handling credentialing data brings HIPAA obligations into your documentation process.

There's a common myth worth addressing. Many new NPs assume they can start practicing the day they get licensed. That's not accurate. As Fitzgerald Health Education Associates explains: "You must first be credentialed with your employer organization before you can begin working for your employer as an NP."

Licensure gives you the right to practice. Credentialing gives you the ability to get paid.

These three terms get used interchangeably all the time. They shouldn't be. Each one means something different, and confusing them leads to wasted applications and missed deadlines during the credentialing process for nurse practitioners.

Here's a clear breakdown:

|

Term |

What It Means |

Who Does It |

When You Need It |

|

Credentialing |

Verification of your education, licensure, board certifications, malpractice history, and background through primary source verification (PSV) |

Insurance payers, hospitals, employer organizations |

Before billing insurance or practicing at a facility |

|

Privileging |

Granting specific clinical privileges based on verified competence and scope of practice |

Hospitals, surgical centers, healthcare facilities |

Before performing procedures or services at a specific facility |

|

Provider Enrollment |

Registering with insurance payers to submit claims and receive reimbursement |

CMS (Medicare), state Medicaid programs, commercial insurers |

Before submitting claims to any payer |

Credentialing is the verification umbrella. Payers and facilities dig into your records to confirm you are who you say you are and that your qualifications are current. Your education gets verified with your school. Licensure gets confirmed with your State Board of Nursing. Certifications get validated with the issuing body.

Privileging is tied to the facility. It determines what clinical services you're authorized to provide within a particular hospital or surgical center. Even after you're credentialed, the facility's medical staff committee decides which clinical privileges to grant based on your training and experience. According to Yale School of Nursing, the nurse practitioner hospital credentialing process, including privileging, can take six weeks to three months depending on the organization.

Provider enrollment is tied to each payer. For Medicare, you'll submit through PECOS, the Provider Enrollment, Chain, and Ownership System. For most commercial insurers, enrollment runs through your CAQH Provider Data Portal profile. Each payer has its own application, timeline, and requirements.

The hospital credentialing process for nurse practitioners often involves all three steps running in parallel: your credentials get verified, clinical privileges get assigned, and provider enrollment applications go out to the facility's contracted payers.

The nurse practitioner credentialing process typically takes 90 to 120 days from start to finish. Some payers move faster. Others drag it out to six months if your paperwork isn't tight.

While exact requirements shift by state and payer, the NP credentialing process follows a predictable sequence. Getting steps out of order is one of the most common reasons applications stall. Here's the credentialing process for nurse practitioners, laid out in the order that actually works.

Before any payer or hospital will look at your application, you need active board certification from an accredited certifying body. This is the foundation everything else builds on.

Your options depend on your specialty:

One thing to flag if you're a recent graduate: as of January 1, 2026, ANCC requires APRN certification candidates to apply within five years of degree conferral. This applies to initial and retest applications. It doesn't affect renewals, but it does mean you can't sit on your degree indefinitely and decide to certify later.

Board certification gets you certified. State licensure gets you legal permission to practice. You need both.

Apply through your state Board of Nursing for your APRN or NP license. What that process looks like depends heavily on where you practice.

Right now, 26 states plus DC grant nurse practitioners full practice authority, meaning no physician oversight required. Reduced practice states need a collaborative practice agreement with a physician. Restricted states require direct supervision or delegation.

Here's what catches people off guard: if you're in a reduced or restricted state, that collaborative agreement isn't just a formality. It's a required credentialing document. Payers won't process your application without a current, fully executed copy. Get it in place before you start submitting anything.

Your National Provider Identifier is the unique 10-digit number that identifies you across every payer, every claim, and every enrollment application. You can't skip it. You can't work around it.

Apply through NPPES (National Plan and Provider Enumeration System). It's free and typically takes one to two business days when you apply online.

You'll need a Type 1 NPI as an individual practitioner. If you're opening your own practice or forming a group, you'll also need a Type 2 NPI for the organization. Don't confuse the two. Claims billed under the wrong NPI type get denied.

If you plan to prescribe controlled substances, you need a DEA registration from the Drug Enforcement Administration. The current fee is $888 for a three-year term.

Some states also require a separate Controlled Dangerous Substance (CDS) certificate. Check your state's requirements before assuming the federal DEA covers everything.

Here's a practical tip: even if you don't plan to prescribe controlled substances right away, some payers still request your DEA number as part of the credentialing process. Having it ready avoids a back-and-forth that can add weeks to your timeline.

This step is where the real credentialing work begins. CAQH is the centralized credentialing database that most commercial payers pull from when they evaluate your application. If your CAQH profile is incomplete, your applications sit in limbo.

As of June 6, 2025, CAQH officially renamed ProView to the CAQH Provider Data Portal. The platform hasn't changed much functionally, but the terminology has. Over 2.5 million providers participate, and roughly 1,000 health plans and organizations use it for verification.

You'll need to complete every section: demographics, education history, licensure, malpractice coverage, practice locations, work history, and professional references. Leave a field blank and it flags your entire profile as incomplete.

CAQH requires re-attestation roughly every 120 days. Miss it and your profile goes inactive. When that happens, every pending payer application tied to your CAQH data stalls. Set a calendar reminder. Treat this like a recurring billing task, not a one-time setup.

Medicare enrollment runs through PECOS (Provider Enrollment, Chain, and Ownership System). Individual NPs file the CMS-855I application. If you're joining or forming a group practice, you'll also need a CMS-855B for reassignment of benefits.

The CMS-855I form has a current revision date of May 1, 2023, with an OMB expiration of May 1, 2026. Processing typically takes 45 to 65 days, though online submissions through PECOS tend to move faster than paper applications.

One 2026 update worth knowing: the CY 2026 Physician Fee Schedule Final Rule permanently allows virtual direct supervision through real-time audio and video for many services, effective January 1, 2026. This changes how some organizations structure NP supervision and incident-to billing. If your practice model relies on either of those, review the updated rules before finalizing your PECOS enrollment.

With your CAQH profile complete, you can start applying to individual commercial payers. Each one has its own application process, even if they pull your data from CAQH.

Target the payers that matter in your market. The usual list includes Medicare, Medicaid, BCBS, UnitedHealthcare, Aetna, Cigna, Humana, Tricare, and Oscar, but regional plans can be just as important depending on your location.

Here's where the insurance credentialing process for nurse practitioners gets tricky. Not all health plans credential NPs separately. Some require NPs to bill under a supervising physician's NPI. Before you invest hours in an application, call the plan's provider enrollment line. Confirm two things: they credential NPs in your specialty, and the panel is open in your area. A quick phone call can save you months of wasted effort on a closed panel.

The payer credentialing process for each insurer typically takes 60 to 120 days. Without consistent follow-up every seven to 14 days, applications can sit untouched in someone's queue.

If you plan to practice in a hospital, surgical center, or any facility-based setting, you'll need clinical privileges through that facility's medical staff office.

This involves submitting your full credentialing file plus documentation of clinical competency specific to the privileges you're requesting. According to Yale School of Nursing, "the privileging process can take 6 weeks to 3 months," depending on the facility's committee meeting schedule.

Even if you're outpatient only, many payers require either admitting privileges at an in-network hospital or an admitting arrangement letter from a physician who has them. That physician must have privileges at a hospital that participates with the same payer you're applying to. Miss this detail and your application gets denied for something that has nothing to do with your qualifications.

Once your applications are in, payers and facilities independently verify everything you've submitted. This isn't a rubber stamp. It's a line-by-line check.

They contact your schools directly to confirm your degrees. State boards confirm your license status. Certifying bodies verify your board certification. They run checks against the OIG exclusion list, the SAM database, and the NPDB (National Practitioner Data Bank).

Primary source verification, or PSV, is where incomplete records or unexplained gaps in your work history create problems. A six-month gap with no explanation triggers additional review. Keep your CV detailed with month-and-year entries for every position, and document any gaps proactively.

When PSV clears, you'll receive an approval letter from each payer. That letter includes your effective date, which is the date you can start billing. Claims submitted for dates of service before that effective date get denied. No exceptions.

Review and sign the provider contract carefully. Pay attention to fee schedules, because you don't have to accept the first rates offered. Negotiation is possible, especially in full practice authority states where NPs practice independently.

Once contracted, verify your listing in the payer's provider directory. Check that your name, address, specialty, phone number, and "accepting new patients" status are all accurate. Directory errors mean patients can't find you, and in states like California, inaccurate directory data can trigger payment delays under SB 137.

At this point, your nurse practitioner credentialing is complete for that payer. Set up ERA (Electronic Remittance Advice) and EFT (Electronic Funds Transfer), submit your first claim under your own NPI, and start getting paid.

Credentialing costs depend on how many payers you're enrolling with, what state you're in, and whether you handle it yourself or bring in outside help. Most NPs don't get a straight answer on pricing until they're already deep into the process.

Here's the breakdown, as transparent as we can make it.

|

Cost Category |

Estimated Cost |

Notes |

|

NPI Registration |

Free |

Through NPPES |

|

DEA Registration |

$888 (three-year term) |

Federal fee, set by DEA |

|

State NP Licensure |

$75 to $400 |

Varies by state |

|

CAQH Profile Setup |

Free |

No cost to providers |

|

Board Certification Exam (ANCC/AANP) |

$290 to $395 |

Initial exam fee |

|

Malpractice Insurance |

$1,200 to $4,500 per year |

Varies by specialty and state |

|

Individual Payer Application |

Free to $100 |

Most are free; some states charge |

|

Medicare Enrollment (CMS-855I) |

Free |

No application fee |

|

Professional Credentialing Service |

$99 to $1,500 per payer |

Depends on provider; MedSole RCM starts at $99 per insurance |

|

Total Estimated Range (First Year) |

$2,500 to $8,000+ |

Depends on number of payers targeted |

|

Factor |

DIY Credentialing |

Outsourced Credentialing |

|

Direct Cost |

$0 (your time) |

$99 to $1,500 per payer enrollment |

|

Time Investment |

40 to 80+ hours |

Two to five hours (your time) |

|

Average Timeline |

120 to 180 days |

60 to 90 days |

|

Error / Rejection Risk |

High (30% to 40% rejection rate on first submissions) |

Low (professional services report 90% to 98% first-pass approval) |

|

Revenue Lost During Delay |

$15,000 to $25,000 per month |

Minimized by faster timeline |

|

Ongoing CAQH / Revalidation |

You manage |

Service manages |

The numbers most people overlook sit in the last two rows. If DIY credentialing takes six months instead of three, that's an extra $45,000 to $75,000 in potential revenue you never billed. The credentialing service fee suddenly looks different when you compare it to what the delay actually costs.

MedSole RCM offers one of the most affordable credentialing options in the industry: $99 per insurance enrollment, with provider enrollment starting at $45 to $60 depending on scope. Some enrollments process even faster than the standard timeline. That pricing exists because credentialing shouldn't be the bottleneck between getting your license and getting paid.

When you partner with experienced nurse practitioner credentialing companies like MedSole RCM, you cut both the timeline and the error risk. And once credentialed, your medical billing process can begin immediately, with no gaps and no revenue interruption.

💡 Not sure what credentialing will cost for your specific practice? MedSole RCM offers free credentialing assessments. Get Your Custom Quote →

Most NPs should plan for 90 to 120 days from first application to approval with commercial payers. That's the realistic window when everything goes smoothly, meaning your documents are current, your CAQH profile is complete, and someone is following up consistently.

Medicare enrollment through PECOS averages 45 to 65 days. Hospital privileging runs six weeks to three months, according to Yale School of Nursing. New nurse practitioners starting from scratch, with no prior payer relationships, should budget closer to four to five months before revenue starts flowing.

|

Payer |

Estimated Timeline |

Key Notes |

|

Centers for Medicare & Medicaid Services (Medicare – PECOS/CMS-855I) |

45 to 65 days |

Online submission faster than paper |

|

Medicaid |

30 to 90 days |

Varies significantly by state |

|

Blue Cross Blue Shield (BCBS) |

60 to 120 days |

Each state plan operates independently |

|

UnitedHealthcare (UHC) |

60 to 90 days |

CAQH-dependent; taxonomy must match |

|

Aetna |

60 to 90 days |

Panel availability varies by region |

|

Cigna |

60 to 90 days |

Panels may be closed in saturated markets |

|

Humana |

45 to 90 days |

Faster processing in some regions |

|

TRICARE |

30 to 60 days |

Federal program, relatively streamlined |

|

Hospital Privileging |

6 weeks to 3 months |

Depends on committee meeting schedules |

These timelines are industry estimates based on typical processing times. Actual results vary by state, payer panel availability, and how complete your application is on the first submission.

When credentialing drags past the 120-day mark, it's almost always traceable to one of these issues:

What usually happens is a combination. The CAQH profile has one missing field, which delays the payer's review by three weeks. Nobody follows up during that window. By the time someone checks, the malpractice certificate has expired and needs to be resubmitted. That's how a 90-day process becomes a six-month one.

The fix is straightforward: get your documents right before you submit, and follow up with every payer at least every seven to 14 days. Or bring in a credentialing team that does this daily. At MedSole RCM, payer follow-up isn't something we do when we have time; it's built into the process from day one. We conduct biweekly follow-ups as a standard practice to ensure applications keep moving and nothing slips through the cracks.

Insurance credentialing for nurse practitioners breaks down into three categories: government programs, commercial plans, and telehealth-specific enrollment. Each one has its own application path, its own timeline, and its own set of requirements that trip people up.

The nurse practitioner insurance credentialing process isn't one application. It's a series of separate enrollments, each with a different payer, different forms, and different follow-up cadences. Let's walk through what each one actually involves.

Medicare enrollment for NPs runs through PECOS using the CMS-855I form for individual practitioners. If you're joining or forming a group, you'll also file a CMS-855B to reassign benefits to the organization's Tax ID.

Medicaid is a different animal entirely. Each state runs its own Medicaid program with its own enrollment portal, application forms, and processing timelines. There's no single national Medicaid application. You apply state by state, and some states take 30 days while others take 90.

If your practice provides or prescribes durable medical equipment, you'll also need DMEPOS enrollment through CMS. That's a separate application with its own supplier standards.

One 2026 regulation worth knowing: the CY 2026 Physician Fee Schedule Final Rule, effective January 1, 2026, permanently allows direct supervision through real-time audio and video. That changes how organizations structure NP supervision models for incident-to billing, which can ripple into how your privileges and credentialing workflows are set up internally.

Medicare credentialing for nurse practitioners isn't optional if you see patients over 65. And given that Medicare beneficiaries make up a large share of most primary care panels, delaying this enrollment means delaying a significant chunk of your revenue.

Commercial payer enrollment is where most of the legwork happens. You're applying individually to BCBS, UnitedHealthcare, Aetna, Cigna, Humana, Oscar, and whatever regional plans dominate your market.

Your CAQH Provider Data Portal profile is the foundation for most of these applications. Payers pull directly from CAQH, so if that profile is incomplete, every downstream application stalls. We've covered CAQH setup in the process section above, but it's worth repeating: keep it current or nothing moves.

Here's something most NPs learn the hard way. Not all health plans credential nurse practitioners separately. Some plans require NPs to bill under a supervising physician's NPI instead of issuing them their own provider contract. Before you spend hours on an application, call the payer's provider enrollment line. Ask two questions: do you credential NPs in my specialty, and is the panel open in my area? A five-minute call saves months of wasted effort.

Contract negotiation is another piece most NPs skip. When you receive a provider contract, you don't have to accept the default fee schedule. Rates are often negotiable, especially in markets with NP shortages or in full practice authority states where NPs practice independently. Accepting the first offer without asking can leave 10% to 20% of potential reimbursement on the table.

MedSole RCM's credentialing and enrollment solutions handle Medicare, Medicaid, and all major commercial payer applications for nurse practitioners, starting at $99 per insurance enrollment.

Telehealth adds a layer that trips up even experienced practice managers. If you're seeing patients virtually across state lines, you need licensure AND payer credentialing in every state where your patients are located. Holding a license in your home state doesn't cover a patient sitting in another one.

The APRN Compact is working toward multi-state APRN licensure, but adoption is still limited compared to the RN Nurse Licensure Compact. Until more states join, telehealth NPs are dealing with separate license applications and separate credentialing processes for each state they serve.

Many payers also require a distinct telehealth enrollment or a telehealth addendum to your existing contract. Don't assume your standard in-network status covers virtual visits automatically.

On the regulatory side, CMS's 2026 PFS Final Rule permanently codifies virtual direct supervision through real-time audio and video for many services. That creates new credentialing and privileging pathways for NPs in telehealth-integrated care models, particularly for services that previously required in-person direct supervision.

Telehealth credentialing for nurse practitioners is one of the fastest-growing areas we handle at MedSole RCM. The rules are still evolving, and getting them wrong means claims denied for services you've already delivered.

Before you submit a single application, gather everything on this list. Missing or expired documents are the number one cause of credentialing delays we see across practices. One absent form can stall your entire timeline by weeks.

Some of these documents take time to obtain, so start collecting them well before you plan to begin the credentialing process. Having your NP credentialing file complete on day one makes everything downstream move faster.

This list covers credentialing requirements for nurse practitioners across most payers and facilities. Some organizations request specialty-specific documents or state-specific forms beyond what's listed here. When in doubt, call the payer's provider enrollment department or ask your credentialing service for the full requirements before you submit.

📋 Want a printable version? Download MedSole RCM's free NP Credentialing Checklist PDF, so you can track every document as you collect them. Download Free Checklist →

Credentialing for nurse practitioners doesn't look the same in every state. The biggest variable is practice authority, which determines how much independence an NP has and what additional documentation payers require before they'll process your application.

Getting this wrong doesn't just slow you down. It can stop your application entirely.

As of 2025, 26 states plus the District of Columbia grant NPs full practice authority. In these states, nurse practitioners can evaluate patients, diagnose conditions, order and interpret diagnostic tests, and prescribe medications, all under the exclusive licensure authority of their state Board of Nursing. No physician oversight required.

Full practice authority states include Alaska, Arizona, Colorado, Connecticut, Delaware, Hawaii, Idaho, Iowa, Maine, Maryland, Minnesota, Montana, Nebraska, Nevada, New Hampshire, New Mexico, North Dakota, Oregon, Rhode Island, South Dakota, Vermont, Washington, Wyoming, and the District of Columbia, among others. The list is growing. Several states have passed FPA legislation in recent years, and more are actively considering it.

For credentialing purposes, FPA makes things simpler. NPs in these states can enroll with insurance payers independently, without submitting a collaborative agreement. That removes one of the most common documentation bottlenecks from the process. Your credentialing application looks almost identical to a physician's.

Not every state gives NPs that level of independence. The distinction matters for credentialing because it changes what documents payers require.

Reduced practice states require a collaborative agreement with a physician. The NP can still practice, but the relationship must be formally documented and the agreement must comply with state-specific language requirements. Payers in these states won't process your credentialing application without a current, fully executed copy. If your collaborating physician retires, moves, or lets the agreement lapse, your active credentialing status is at risk too.

Restricted practice states go further, requiring direct supervision, delegation, or team management by a physician. The documentation requirements are heavier, and some payers in restricted states have additional hurdles for NP credentialing compared to physician applications.

Here's the practical takeaway: if you practice in a reduced or restricted state, get your collaborative or supervisory agreement in place and reviewed by someone who knows your state's specific requirements before you begin credentialing. Having a clean, compliant agreement ready on day one prevents one of the most common application rejections we see.

NPs who practice across state lines, whether through telehealth, locum tenens work, or multi-location practices, face a layered credentialing challenge. Each state requires its own NP licensure, and each state's payers require their own credentialing applications.

The Nurse Licensure Compact (NLC) allows RNs to hold a multi-state license, but APRN compact adoption is still limited. The APRN Compact exists, but far fewer states have enacted it. Until broader adoption happens, multi-state NP credentialing means applying for separate licenses and separate payer enrollments in each state.

That's a lot of parallel workflows running at once. Each state has different processing times, different Board of Nursing requirements, and different payer landscapes. Missing a deadline in one state can stall your ability to see patients there for months.

For NPs building a telehealth practice or expanding into new markets, multi-state credentialing is where the complexity scales fast. It's also where having a credentialing team that tracks applications across multiple states simultaneously becomes less of a convenience and more of a necessity.

Nurse practitioner credentialing requirements shift depending on your board certification and specialty. Payers match your certification to a specific taxonomy code, and if those don't align, your application gets denied. It's one of the most common rejection reasons we see, and it's entirely preventable when you know what each specialty requires.

FNPs make up the largest segment of the NP workforce. That's good news for credentialing, because most payers are actively looking for primary care providers and FNP panels tend to have availability.

Certification comes through either ANCC (FNP-BC) or AANP (FNP-C). Your credentialing taxonomy code is 363LF0200X, which maps to the family practice NP classification in the NPPES system.

The credentialing process for a family nurse practitioner is typically the most straightforward of any NP specialty. Broad scope of practice, high demand, and open panels across most markets mean fewer barriers. If you're starting your first practice, FNP credentialing is about as smooth as this process gets.

Behavioral health is the fastest-growing NP specialty right now. Demand for psychiatric nurse practitioner credentialing has surged, and payers know it. In many markets, behavioral health panels have shorter wait times than primary care panels because the supply of providers hasn't caught up with the need.

Certification runs through ANCC only: the PMHNP-BC credential. There's no AANP equivalent for this specialty.

Two things make PMHNP credentialing different from other specialties. First, DEA registration is non-negotiable. Psychiatric medications frequently include controlled substances, and payers won't credential a PMHNP who can't prescribe them. Second, some payers route behavioral health credentialing through a separate department or even a separate managed behavioral health organization. Don't assume your standard commercial payer application covers the behavioral health side automatically. Ask.

PMHNPs also tend to be strong telehealth candidates, which means multi-state licensure and telehealth-specific credentialing often come into play. If that's your model, plan for the added complexity upfront.

Beyond FNP and PMHNP, several other NP specialties have their own certification and credentialing pathways:

The key credentialing principle across all specialties is the same: your board certification must align with the payer's specialty taxonomy for credentialing approval. An NP certified as an FNP who tries to credential under a pediatric taxonomy gets flagged. A PMHNP applying with a primary care taxonomy code gets rejected.

Before you submit any application, verify your taxonomy code matches your certification in the NPPES registry. It takes two minutes to check and can save you months of back-and-forth with a payer.

Not every NP needs to outsource credentialing. But most who try to do it themselves wish they had.

The question isn't whether you're capable of filling out the paperwork. It's whether you have 40 to 80 hours to dedicate to applications, phone calls, follow-ups, and tracking spreadsheets while also seeing patients, managing staff, and running a practice.

If any of these sound familiar, DIY credentialing probably isn't the best use of your time:

Here's what the process actually looks like when you do it yourself: 30 to 100 pages of applications per payer, phone calls to verify receipt every two weeks, strict deadlines that reset if an application gets lost or expires. Miss one follow-up window and the application can sit untouched for months. Most NPs underestimate the time commitment until they're in the middle of it.

Not all NP credentialing services are built the same. Before you sign with anyone, evaluate them against these criteria:

That last point matters more than most people realize. A credentialing company that hands you back a completed enrollment and walks away leaves a gap in your revenue cycle. The best credentialing services for nurse practitioners connect enrollment directly to billing operations.

MedSole RCM checks every box on that list, and we built our credentialing process specifically to eliminate the gap between enrollment approval and your first paid claim.

Our NP credentialing services include full CAQH Provider Data Portal setup and maintenance, PECOS enrollment for Medicare, applications to all major commercial payers, state licensure assistance, hospital privileging support, and ongoing re-credentialing and compliance monitoring.

Pricing is straightforward: $99 per insurance enrollment, with provider enrollment starting at $45 to $60 depending on complexity. No hidden fees. No vague "custom quotes" that change after you've signed.

As a full-service revenue cycle management company, MedSole RCM ensures that your credentialing flows directly into billing. Once your effective date is confirmed, our medical billing team begins claims submission immediately. There's no gap between getting credentialed and generating revenue. That's the difference between a standalone credentialing vendor and an integrated RCM partner.

Ready to eliminate credentialing delays? Our full-service NP credentialing and billing support gets you credentialed and billing in as little as 60 days. MedSole RCM's full revenue cycle management capabilities mean credentialing is just the starting point; we handle billing, coding, denial management, and collections too.

🚀 MedSole RCM has credentialed thousands of providers across all 50 states. If you'd rather focus on patients than paperwork, schedule a free credentialing consultation →

Credentialing rules don't stay static. Several regulatory changes took effect in 2025 and 2026 that directly impact how NP credentialing works, how fast documents need to be verified, and what certifying bodies expect from new applicants. If you're using a credentialing playbook from even two years ago, some of it is already outdated.

Here's what's different right now.

NCQA updated its Credentialing and Provider Network standards with changes that took effect for files processed on or after July 1, 2025. The biggest shift: a 120-calendar-day verification time limit for credentialing files. Payers operating under NCQA accreditation now have a defined window to complete primary source verification, and stale documents push your file to the back of the line.

NCQA also moved to require monitoring at least every 30 days for sanctions, exclusions, and license expirations. That's a significant jump from the less frequent checks that were standard before.

On top of that, NCQA is consolidating its credentialing products into a Single Credentialing Program, which streamlines the framework but also tightens expectations across the board.

What this means practically: if your credentialing file used to survive with slow document turnaround, those days are over. Keep a credentialing-ready packet current at all times. License renewals, malpractice certificates, board certifications, all of it should be updated the day it changes, not when a payer asks for it.

CAQH ProView is now officially the CAQH Provider Data Portal. The new Terms of Service took effect June 6, 2025. Functionally, the platform works the same way. But official communications from payers and credentialing organizations now reference the new name, so don't be confused when you see it.

The numbers behind CAQH haven't changed: 2.5 million providers participate, roughly 1,000 health plans and organizations use it, and the platform now includes continuous sanctions monitoring that flags sanctioned providers daily. Your re-attestation cadence remains approximately every 120 days.

Starting January 1, 2026, ANCC requires all initial and retest APRN certification candidates to apply within five years of degree conferral. If you graduated with your MSN or DNP and waited longer than five years to sit for your certification exam, you're no longer eligible under the current rules.

This doesn't affect NPs who are already certified and renewing. But for new graduates planning their credentialing timeline, certification timing just became a hard deadline rather than an open-ended option.

The CY 2026 Physician Fee Schedule Final Rule permanently allows direct supervision to be met through real-time audio and video communication. Audio-only doesn't qualify. This applies to services where CMS requires direct supervision, which often comes up in incident-to billing arrangements.

For NP credentialing, the practical impact shows up in how organizations structure their supervision models. Facilities that previously required on-site physician presence for certain NP-delivered services can now meet that standard virtually. That may change privileging requirements and expand the types of services NPs can be credentialed to perform in certain settings.

If your practice uses incident-to billing or operates under a collaborative supervision model, review the updated rule to understand how it affects your internal credentialing and privileging workflows.

Getting credentialed is only half the job. Staying credentialed is the other half, and it's the part most NPs and practice managers forget about until something breaks.

Credentialing for nurse practitioners isn't a one-time event. It's a recurring cycle with hard deadlines. Miss one, and you can lose network participation, start getting claims denied, or get pulled from payer directories without warning.

Most commercial payers require NP credentialing renewal every two to three years. The NCQA standard is 36 months, and since most major payers operate under NCQA accreditation, that's the cadence you should plan around.

Hospital privileges get reviewed on a different schedule, typically annually or every two years depending on the facility's medical staff bylaws.

Medicare revalidation follows its own cycle, set by CMS. You'll receive a revalidation notice, but relying on CMS mail to arrive on time is risky. Track it yourself.

Here's what happens when re-credentialing deadlines slip: network termination, active claim denials, and removal from the payer's provider directory. Patients who search for you online suddenly can't find you listed as in-network. New referrals dry up. Revenue drops before you even realize the credentialing lapsed.

Some payers are enforcing directory accuracy even more aggressively now. UnitedHealthcare in California, for example, requires quarterly demographic updates under CA SB 137. Failure to comply can trigger directory removal and payment delays. Expect more states and plans to follow that model.

Your CAQH Provider Data Portal profile requires re-attestation approximately every 120 days. That means confirming your information is accurate and current roughly four times a year. Skip an attestation and the profile goes inactive. When that happens, every payer that pulls from CAQH stops processing anything tied to your file.

Don't wait for the attestation reminder to make updates. Any time you renew your license, switch malpractice carriers, change practice locations, or earn a new board certification, update CAQH immediately. With NCQA now requiring at least monthly monitoring for sanctions, exclusions, and license expirations, stale data gets flagged faster than it used to.

Think of your CAQH profile as a living document. Treating it like a one-time setup is one of the most common reasons NP credentialing lapses turn into billing disruptions.

Most nurse practitioner credentialing issues aren't complicated. They're predictable. The same problems show up over and over, and they're almost always preventable when you know what to watch for.

Get quick highlights instantly

Recent Blogs

Posted Date: Jun 24, 2025

Posted Date: Jun 26, 2025

Posted Date: Jun 28, 2025

Posted Date: Jun 30, 2025

Posted Date: Jul 02, 2025

Posted Date: Jul 04, 2025

Posted Date: Jul 07, 2025

Posted Date: Jul 09, 2025

Posted Date: Jul 11, 2025

Posted Date: Jul 14, 2025

Posted Date: Jul 16, 2025

Posted Date: Jul 18, 2025

Posted Date: Jul 22, 2025

Posted Date: Jul 23, 2025

Posted Date: Jul 25, 2025

Posted Date: Jul 28, 2025

Posted Date: Aug 01, 2025

Posted Date: Aug 04, 2025

Posted Date: Aug 06, 2025

Posted Date: Aug 08, 2025

Posted Date: Aug 11, 2025

Posted Date: Aug 14, 2025

Posted Date: Aug 18, 2025

Posted Date: Aug 20, 2025

Posted Date: Aug 25, 2025

Posted Date: Aug 27, 2025

Posted Date: Aug 29, 2025

Posted Date: Sep 03, 2025

Posted Date: Sep 05, 2025

Posted Date: Sep 08, 2025

Posted Date: Sep 15, 2025

Posted Date: Sep 18, 2025

Posted Date: Sep 22, 2025

Posted Date: Sep 24, 2025

Posted Date: Sep 26, 2025

Posted Date: Sep 29, 2025

Posted Date: Oct 02, 2025

Posted Date: Oct 13, 2025

Posted Date: Oct 16, 2025

Posted Date: Oct 23, 2025

Posted Date: Oct 27, 2025

Posted Date: Oct 28, 2025

Posted Date: Oct 30, 2025

Posted Date: Oct 31, 2025

Posted Date: Nov 03, 2025

Posted Date: Nov 05, 2025

_11zon.webp)

Posted Date: Nov 11, 2025

.webp)

Posted Date: Nov 14, 2025

Posted Date: Jan 05, 2026

.png)

Posted Date: Jan 02, 2026

Posted Date: Jan 06, 2026

Posted Date: Jan 07, 2026

Posted Date: Jan 08, 2026

Posted Date: Jan 15, 2026

Posted Date: Jan 13, 2026

Posted Date: Jan 21, 2026

Posted Date: Jan 22, 2026

Posted Date: Jan 26, 2026

Posted Date: Jan 27, 2026

Posted Date: Jan 28, 2026

_11zon.webp)

Posted Date: Jan 29, 2026

Posted Date: Jan 30, 2026

Posted Date: Feb 02, 2026

Posted Date: Feb 03, 2026

Posted Date: Feb 04, 2026

Posted Date: Feb 05, 2026

_11zon.webp)

Posted Date: Feb 06, 2026

Posted Date: Feb 09, 2026

Posted Date: Feb 10, 2026

_11zon.webp)

Posted Date: Feb 11, 2026

.webp)

Posted Date: Feb 12, 2026

Posted Date: Feb 13, 2026

Posted Date: Feb 17, 2026