Posted By: Medsole RCM

Posted Date: Sep 26, 2025

A medical coding audit isn’t just a compliance checkpoint anymore—it’s one of the most reliable ways for a healthcare organization to protect its revenue, validate its documentation, and avoid costly payer scrutiny. In 2025, coding accuracy is no longer measured by how many errors you find but by how consistently your codes align with medical necessity, payer policies, and the actual story told in the chart. Practices that treat audits as an annual task fall behind; practices that treat them as a strategic engine outperform, collect faster, and stay audit-ready all year long.

This guide breaks the subject down with uncommon clarity. You’ll understand how coding audits work, why they matter, how they affect cash flow, and where most practices lose money without realizing it. Most importantly, you’ll see how coding accuracy, compliance, and revenue integrity connect—and how getting them right can transform the entire financial performance of a healthcare organization.

A medical coding audit is nothing more than checking that the codes on your claims match the records in your clinical notes. An audit will be a full investigation of all CPT, ICD-10-CM and HCPCS codes to make sure that the notes support the reported codes. Most clinicians do not realize how often small discrepancies are inadvertently introduced: a piece of information left out in the HPI, a modifier added by reflex, or a diagnosis carried forward that no longer applies. Payers use these seemingly insignificant gaps as justifications to either refuse or reverse payments.

In 2025, the stakes are higher than they’ve ever been. Payers are using audit algorithms that work faster than humans and don’t overlook anything—not even one mismatched detail. A well-run medical coding audit gives you a clear picture of where your coding stands, where documentation needs tightening, and whether your revenue is protected. It’s not just compliance anymore; it’s a practical way to keep cash flow steady and avoid the kind of issues that turn into costly appeals, recoupments, or surprise reviews.

A coding audit, in essence, has only one thing to determine: Does the claim reflect what was done, stated and documented? All other aspects—accuracy, compliance, risk management, and revenue integrity—derive from that single point of alignment. When an audit is done properly, it exposes patterns that day-to-day coding work never reveals: subtle documentation drift, repeated under-coding in certain visit types, charge capture gaps in procedures, or modifiers applied as a habit rather than necessity

Accuracy protects your reimbursements.

Compliance protects your organization from payer scrutiny.

Risk mitigation protects your licensure and reputation.

Preventing revenue leakage protects your cash flow.

A strong coding audit pulls these threads together into a clear picture of how well your coding engine is performing. And in 2025—when payers are using predictive algorithms instead of human reviewers—this alignment has become non-negotiable.

Most failures don’t come from “bad coders.” They come from blind spots in the documentation–coding–billing chain that no one is trained to catch.

Here’s why providers repeatedly fail coding audits—even the ones who believe they’re doing everything right:

Notes often “look complete” but miss the micro-details needed to support higher E/M levels, complex procedures, or time-based coding. Auditors see these gaps instantly; providers rarely do.

Providers document comorbidities clearly, but coders avoid adding them because they’re unsure whether they affect medical necessity. Payers see that as incomplete risk representation.

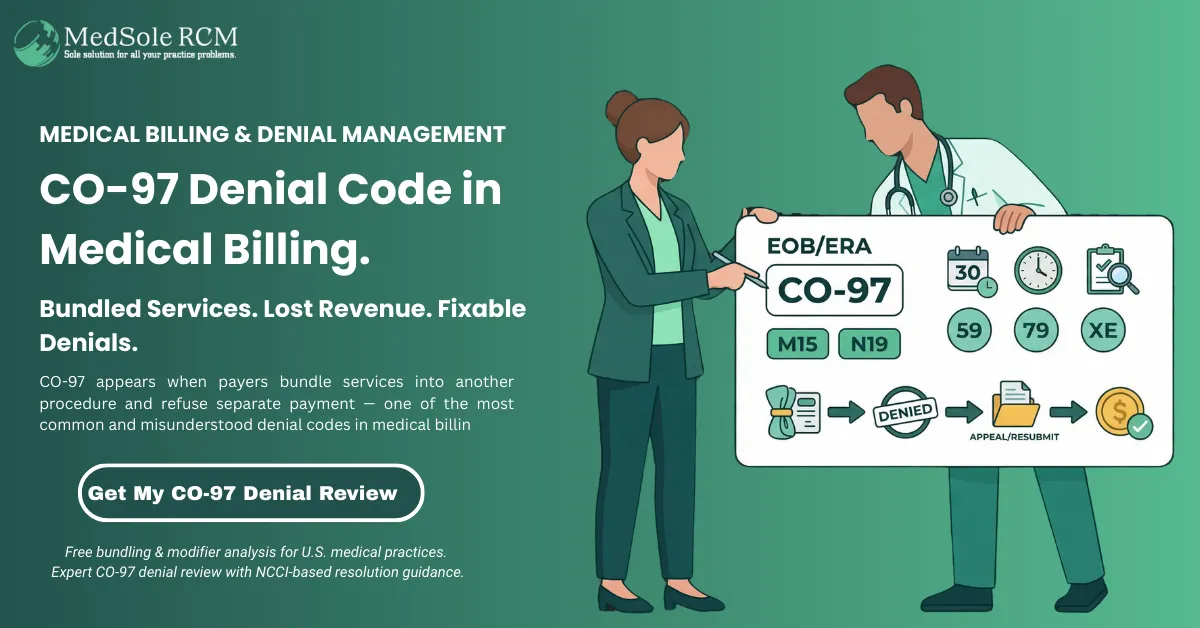

Modifier 25, 59, XE/XS/XU, and 26 are the top red flags for audit teams. They’re either overused, misused, or missing entirely—each scenario triggers denials or retrospective reviews.

Even when documentation is correct, codes often fail because they clash with NCCI edit pairs. Many coders don’t inspect them consistently due to time pressure, and errors accumulate.

Audit Reality Check

“Up to 55–60% of inpatient charts fail accuracy standards in internal reviews.”

This is one of the highest failure ranges across all coding environments—proof that even well-resourced systems struggle without structured audits.

Understanding the different types of medical coding and audit processes is the foundation of every successful compliance program. In 2025, coding teams aren’t just expected to code claims—they’re expected to defend them. Structured medical coding auditing approaches are designed to detect various types of risk, documentation gaps, and DRG validation concerns before payers do.

The following is a concise, no-nonsense overview of every audit type that healthcare leaders must understand.

A retrospective audit reviews claims after they’ve been submitted. It’s the most common model because it shows the real-world accuracy of coding and documentation under pressure. Retrospective reviews help uncover missed secondary diagnoses, incorrect sequencing, unreported procedures, and DRG validation discrepancies. This audit type is especially powerful when identifying patterns that cause silent revenue leakage or recurring denial drivers.

Looking Ahead, A prospective audit finds errors before a claim leaves the door. It eliminates denials at the front end, guarantees coding accuracy, and confirms that documentation supports medical necessity. This model plays out very effectively for higher-risk/faltered specialties: cardiology, orthopedics, pain management, and behavioral health—where a single missing modifier or incorrect CPT® code can raise payer attention or recoupments.

Internal audits help organizations maintain ongoing accuracy, but they often miss blind spots due to familiarity bias. That's why successful companies alternate between internal assessments and external audits conducted by expert medical coding companies. External teams have the latest audit tools, up-to-date knowledge of regulations, and impartial monitoring. Such monitoring is important when dealing with payer audits or getting ready for accreditation.

|

Audit Type |

Best For |

Risk Level |

Use Case |

Required Tools |

|---|---|---|---|---|

|

Retrospective Audit (Post-Bill) |

Identifying patterns, denial root causes, and DRG validation |

Medium |

Quarterly reviews, compliance reporting |

Encoder, audit software, remittance analysis tools |

|

Prospective Audit (Pre-Bill) |

Preventing denials and revenue leakage |

Low |

High-risk specialties, new coders, and documentation gaps |

EHR access, coding guideline checker, NCCI edit tools |

|

Internal Audit |

Routine monitoring & KPI benchmarking |

Medium |

Monthly quality checks |

CDI platform, internal audit templates |

|

External Audit |

Full compliance assurance, unbiased validation |

Low → High (depending on findings) |

Preparing for payer audits, RAC/UPIC readiness |

Third-party audit systems, coding audit software |

A high-quality audit is not a quick chart review—it’s a structured, end-to-end analysis of coding behavior, documentation integrity, and reimbursement risk. Modern medical coding audit services go far beyond simple error-spotting. They explain why mistakes happen, how documentation affects coding choices, and where money is invisibly leaking during the encounter lifecycle.

In 2025, every top-tier audit must have these three main parts.

Quality documentation serves as the foundation for code accuracy. An expert audits each interaction to ensure that every diagnosis, procedure, and modifier is backed by clear, full documentation—and that the service satisfies payer-defined medical necessity.

This step highlights the most significant concealed threats: documentation gaps, missing items in HPI, perplexing exam results, and insufficient treatment narratives. These gaps trigger denials, down-coding, and payer suspicion long before coding mistakes do.

This step checks to see if the CPT, HCPCS, and ICD-10-CM codes that were given accurately tell the clinical story. Auditors check to see if the rules are being followed by the most recent guideline revisions, payer policies, and NCCI edit rules.

It includes a profound look at modifier accuracy, bundling/unbundling behavior, ignored add-on codes, and incorrect sequencing.

This is where most financial leakage—and compliance exposure—lives. Even one recurring misuse of a common modifier (e.g., -25, -59, -XS, -XU) can distort thousands of encounters.

Charge capture failures hurt providers more than denials, and they’re often invisible until an audit uncovers them.

This portion of the audit compares provider documentation against submitted charges to identify:

It also analyzes revenue leakage patterns—for example, recurring errors by a specific coder, specialty, or template.

|

Audit Component |

What It Evaluates |

Why It Matters |

|---|---|---|

|

Documentation Integrity |

Completeness, clarity, medical necessity, and missing elements |

Prevents denials, improper payments, and misaligned coding |

|

Code Validation (CPT/HCPCS/ICD-10-CM) |

Code selection accuracy, guideline adherence, and sequencing |

Ensures compliance and correct reimbursement |

|

Modifier Accuracy |

Appropriateness, NCCI edit conflicts, and billing justification |

Avoids bundling errors and fraud flags |

|

Charge Capture Review |

Missed charges, underbilling, unused add-on codes |

Protects against silent revenue loss |

|

Diagnosis-to-Procedure Alignment |

Medical necessity and clinical logic |

Reduces payer audits and recoupments |

|

Payer-Specific Rules Check |

LCD/NCD criteria, prior authorization needs |

Improves first-pass payment outcomes |

|

Encounter Pattern Analysis |

High-risk codes, utilization trends |

Identifies systematic issues, not isolated mistakes |

The days of manual, line-by-line chart reviews are over. Any organization committed to accuracy and revenue integrity now relies on a sophisticated medical coding audit tool ecosystem—platforms that don’t just detect errors but expose behavioral patterns, utilization anomalies, and coding drift long before they turn into denials or compliance risk.

What truly characterizes high-performing practices is how seamlessly their audit technology combines with EHR workflows, payer standards, and real-time validation tools to generate consistent, high-fidelity coding results.

The audit technologies that define 2025, as well as those that your competitors rarely discuss, are listed below.

Encoders remain the backbone of modern audit operations, but today’s tools go far beyond code lookup.

The best encoders connect directly to EHR data, use real-time updates for coding guidelines, and automatically point out any mismatches between diagnoses, procedures, and the need.

They also cross-check against NCCI edits, payer-specific LCD/NCD rules, and internal templates—allowing auditors to validate assignments with far more precision than any manual review could deliver.

Encoders now serve as both a validation engine and a standardization layer that prevents coder-to-coder variation.

This is the single area most competitors never touch—yet it’s where the biggest audit breakthroughs are happening.

AI-driven pattern recognition tools analyze thousands of encounters at once to detect trends auditors typically find months later:

What makes this transformative is the emergence of the predictive audit model—AI models that forecast which encounters are most likely to contain inaccuracies or trigger denials.

Instead of reviewing 100 charts to find 12 issues, auditors review the 12 charts most likely to contain them.

This is proactive auditing, not reactive cleanup—and almost no competitor is talking about it.

Modern audit teams don’t operate from static reports anymore. They track live operational metrics that reflect the health of coding, documentation, and reimbursement.

The best dashboards consolidate:

A consolidated view of coder accuracy, documentation completeness, coding turnaround time, and error recurrence.

Tracks submission quality at the encounter level—and exposes whether coding issues, documentation gaps, or registration errors are harming performance.

Visualizes denial movement (by code, provider, specialty, and payer).

This allows auditors to identify the root cause behind every denial cluster instead of fixing symptoms.

KPI dashboards turn auditing into a continuous feedback system—one where errors decrease steadily, and coders improve month over month. Few organizations leverage this correctly, which is why audit-driven improvement is still a competitive advantage, not a standard.

A strong medical coding and auditing program isn’t built on chance—it’s built on structure.

The best-performing organizations don’t “hope” their coding is accurate; they follow a workflow that removes guesswork, reveals blind spots, and gives leadership absolute clarity on where revenue and compliance risks are hiding.

Here’s the exact process top health systems rely on in 2025, broken down step-by-step.

Every successful audit begins with a basic question: what are we trying to correct?

This initial phase establishes the parameters—specialties to investigate, periods to review, payer mix to include, and whether the focus should be on documentation quality, coding accuracy, revenue leakage, or compliance vulnerability.

This is also where teams bring in intel from previous denials, documentation gaps noted by coders, NCCI conflicts, or repeat problem patterns. It’s slow, thoughtful work—but it prevents wasted time and gives the audit a surgical level of precision.

Once the scope is clear, the next move is choosing a sample size that actually means something.

This isn’t about “picking a few charts.”

It’s about choosing a statistically defensible sample that tells the truth about your coding ecosystem.

Most organizations use RAT-STATS—the same sampling tool used by the OIG—because it removes bias and helps prove that your audit findings weren’t based on selective chart pulling.

A sample that’s too small hides problems.

A sample that’s too large becomes noise.

A well-built sample reveals patterns your team would never spot on their own.

Before the actual reviewing begins, auditors gather every scrap of supporting documentation tied to the encounter: provider notes, operative reports, test results, modifiers, claim forms, RAs/EOBs, and any attachments used for payer submission.

This step matters more than most organizations realize.

If even one supporting document is missing—or one clinical detail was never charted—the entire audit becomes unreliable.

A beneficial rule: If it wasn’t documented, it can’t be defended.

That principle forms the backbone of every successful audit.

This is the part people think of when they hear “coding audit,” but it’s only half the story.

A skilled auditor doesn’t just confirm whether a CPT, HCPCS, or ICD-10-CM code matches the note.

They study the decision-making behind it:

This is detailed work—slow, meticulous, and often eye-opening for leadership.

Here’s where elite audits separate themselves from “basic chart reviews.”

Anyone can point out errors.

But only a few auditors can explain why those errors continue to happen.

Root cause analysis answers questions no competitor dares to touch:

This step reveals the underlying patterns—systemic issues that remain invisible until someone with enough experience connects the dots.

Root cause analysis is what transforms an audit from an obligation into an ROI engine.

From here, auditors shape a precise corrective action plan that includes coder retraining, provider feedback, template revisions, and compliance updates—plus a timeline for follow-up review.

A real audit report isn’t just a list of findings.

It’s a roadmap that lifts accuracy, strengthens compliance, and stops revenue leakage at its source.

Every claim that leaves your billing system isn’t just a request for payment—it’s a compliance statement. It declares that your organization followed payer policies, documented medical necessity, and coded every service according to federal standards.

A healthcare coding and compliance audit acts as your first line of defense. It protects against the trifecta of modern risk: overpayment recovery, fraud, waste and abuse (FWA), and data-driven payer scrutiny.

In 2025, RACs, SMRCs, and UPICs aren’t waiting for red flags — they’re finding them through algorithms and claim pattern analytics. Your job is to find them first.

Recovery Audit Contractors (RACs) and Supplemental Medical Review Contractors (SMRCs) are designed to do one thing: recover every cent of overpaid money.

Their audit selections aren’t random; they’re driven by machine learning models that detect aberrant billing patterns, excessive E/M upcoding, and modifier misuse across provider groups.

Typical RAC/SMRC triggers include:

A forward-thinking compliance audit reviews exactly these patterns internally before a RAC does.

By reverse-engineering RAC’s playbook, you’re not reacting to audits—you’re preventing them.

Unified Program Integrity Contractors (UPICs) and their predecessor ZPICs (Zone Program Integrity Contractors) operate at a higher level of scrutiny — investigating not just overpayments, but potential fraud, waste, and abuse (FWA) cases.

They don’t just review coding accuracy — they analyze intent, pattern, and profit motive.

UPIC/ZPIC reviews focus on:

UPICs integrate AI-driven anomaly detection with claims history. If your compliance team isn’t already monitoring for these outliers, your audit risk is exponentially higher.

The Office of Inspector General (OIG) doesn’t directly audit every provider — but their compliance program guidance shapes how every payer and regulator evaluates you.

OIG expects organizations to maintain a structured compliance program that includes:

A healthcare coding and compliance audit isn’t just about claims—it’s about proving that your organization operates under a culture of compliance.

OIG alignment transforms your audit from a reactive event into a preventive posture.

Each red flag isn’t just a billing mistake — it’s a compliance vulnerability.

Your audit’s purpose is to spot these before the RACs, UPICs, or OIG do.

“Compliance isn’t about fearing audits—it’s about mastering them.

The providers who treat audits as an internal control, not a punishment, are the ones who thrive under payer scrutiny.”

Most providers treat claim audits and coding audits as if they’re interchangeable.

They’re not—and misunderstanding the difference is exactly why organizations lose money, fail compliance reviews, or get caught off guard during payer audits.

A medical claim audit assesses the full claim lifecycle, including documentation, coding, billing, coverage regulations, claim form correctness, and payer-specific criteria.

A medical coding audit concentrates specifically on code accuracy, guideline adherence, and documentation sufficiency.

The smartest organizations run both. The riskiest ones run neither.

A claim audit looks at the full ecosystem:

A coding audit, by contrast, zooms in on:

The intersection matters:

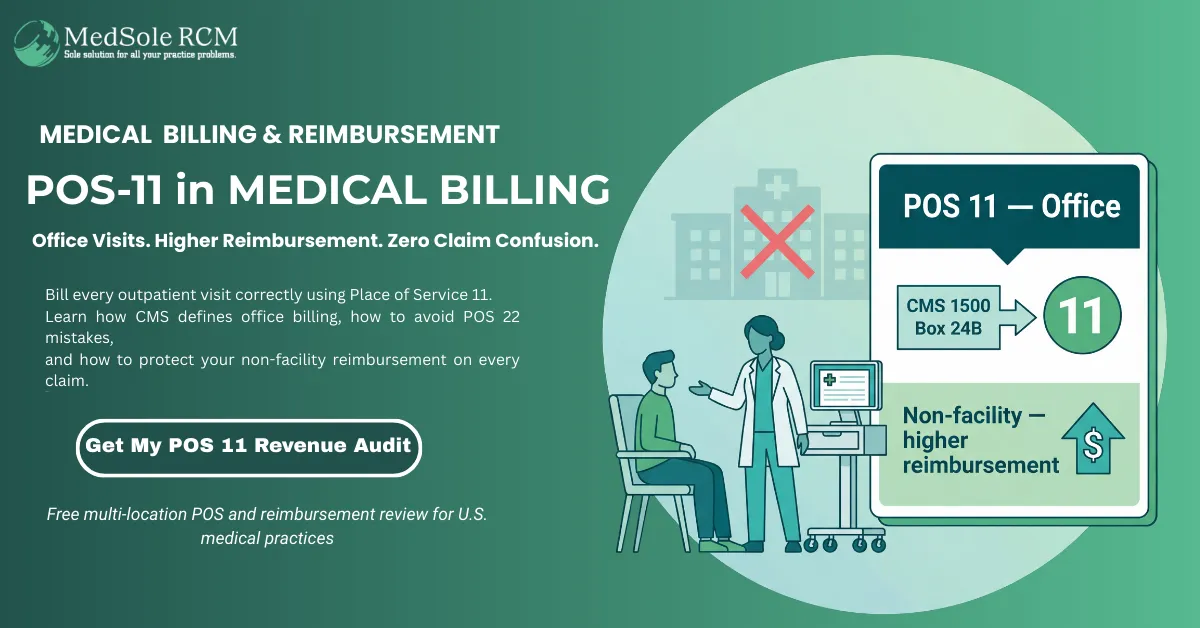

A claim can be coded perfectly… yet still fail because the claim form was built incorrectly, an LCD wasn’t met, the POS code was wrong, or payer guidelines weren’t followed.

Claim audits protect the revenue cycle.

Coding audits protect accuracy and compliance.

Both together protect your organization.

The most dangerous coding errors are the ones coders never see — because they only show up when the claim hits a payer.

Examples where a medical claim audit exposes hidden coding issues:

Claim audits show you how a payer interprets your coding.

Coding audits show you how a coder assigned your coding.

Your revenue cycle only stabilizes when both perspectives align.

In every hospital or medical group, healthcare revenue integrity isn’t a buzzword—it’s the system that keeps cash flow predictable, payer relationships stable, and compliance risks under control.

Coding audits sit at the center of that system.

Most organizations think revenue integrity in healthcare is “fixing denials.”

In reality, it’s about preventing revenue from leaking out long before a claim reaches the payer.

A robust coding audit program strengthens clinical revenue integrity by ensuring that the care documented, the codes submitted, and the dollars collected are aligned—every time, every encounter.

If you ask any CFO where the real financial bleeding happens, they’ll tell you:

It’s not in denials — it’s in the revenue that never makes it to the claim.

Coding audits uncover leakage that RCM teams often never detect, including:

Every missed code is a silent revenue loss.

This is why organizations with monthly audits consistently outperform those with annual checks—they don’t wait a year to discover six-figure leakage.

From a compliance perspective, revenue integrity in healthcare is inseparable from FWA prevention.

Coding audits reduce exposure by identifying patterns that could trigger:

Examples of audit-flag behaviors:

When these patterns surface early, organizations can correct them internally instead of discovering them through a payer letter.

Clinical revenue integrity isn’t only about maximizing revenue — it’s about stabilizing cash flow.

A coding audit improves the clean claim rate by:

Strong audit programs typically produce:

Clean claims = predictable reimbursements = higher financial resilience.

|

Coding Error Type |

Primary Risk |

Financial Impact |

Real-World Example |

|---|---|---|---|

|

Missing secondary dx |

Lower RAF/risk score |

$50–$500 per encounter lost |

CHF, CKD, COPD uncoded |

|

Incorrect modifiers |

Denials / partial pay |

20–40% reimbursement loss |

Missing -59 / wrong -25 |

|

Upcoding |

Compliance exposure |

Repayment + extrapolation |

E/M upcoded w/o criteria |

|

Undercoding |

Silent leakage |

Thousands/month lost |

Level 4 coded as Level 3 |

|

LCD/NCD mismatch |

Medical necessity denial |

Claim written off |

Incorrect ICD pairing |

|

Wrong HCPCS supply codes |

Payer takebacks |

10–30% reductions |

DME/infusion billing errors |

|

Time-based inaccuracies |

Downcoding |

15–25% revenue reduction |

Psychotherapy, infusion |

|

Bundling errors |

Payer recoupments |

Full service reversal |

Incorrectly unbundled |

|

Missed charge capture |

Lost revenue |

Highest leakage category |

Missed injections, add-ons |

|

Documentation gaps |

Claim delays & denials |

AR days increase |

Notes not supporting CPT |

Anyone can tell you what a coding audit is.

Only a few can tell you what a coding audit becomes when it matures — when it evolves from compliance paperwork to a data-driven system that prevents risk, predicts denials, and amplifies revenue accuracy.

These insights don’t exist on any competitor blog — because they come from inside the audit room.

Coding audits, like organizations, evolve in maturity.

Where your practice sits on this ladder determines how much money you lose—or protect—every quarter.

Stage 1 — Reactive (Audit After Denial):

Audits only happen when denials pile up. It’s damage control, not strategy. No patterns are tracked; no insights are logged.

Stage 2 — Structured (Scheduled Audits):

Audits occur quarterly or semi-annually. Coding compliance is monitored, but insights still live in spreadsheets. Results don’t change behavior.

Stage 3 — Data-Informed (Metrics-Driven Auditing):

Teams begin tracking KPIs — clean claim rates, coder accuracy %, and denial ratios. Each audit produces measurable outcomes and corrective plans.

Stage 4 — Predictive (Proactive Risk Management):

Audits integrate machine learning and EHR data to predict where errors will occur. Coders receive real-time alerts before claims are submitted.

Stage 5 — Integrated (Clinical + Financial Fusion):

Compliance, coding, and revenue integrity merge. CDI, coding, and billing teams collaborate under one “revenue intelligence” system.

Audits don’t find errors anymore—they prevent them.

Insight Box:

“Less than 12% of healthcare organizations in the U.S. operate at Stage 4 or above on the Audit Maturity Ladder—yet they enjoy 20–25% faster reimbursement cycles and 40% fewer payer takebacks.”

This is where MedSole RCM can help providers leapfrog years ahead—building real audit intelligence from the inside out.

While most competitors still rely on manual chart reviews, next-gen auditing integrates AI-based risk modeling that pinpoints trouble before the payer ever notices.

Predictive audit models use:

Think of it as the “weather radar” for compliance storms.

Instead of reacting to RAC or SMRC audits, predictive auditing forecasts risk — letting you fix documentation, education, or workflows before exposure hits.

Example:

An AI model noticed that a cardiology group billed CPT 93015 (Cardiac stress test with supervision) 27% more frequently than peer practices.

The flag wasn’t fraud — it was an outdated EHR template missing proper supervision documentation.

Fixing it internally prevented a six-figure RAC exposure.

No competitor explains this — because most don’t even know predictive auditing exists.

Even seasoned coders miss these — but expert auditors hunt for them instinctively.

Each of these errors hides behind “clean claims” that still drain your revenue integrity:

|

Hidden Error |

What It Looks Like |

Why It Matters |

|---|---|---|

|

Modifier Overlap |

Use of -25 and -59 without clinical justification |

Creates FWA red flags, triggers payer reviews |

|

Secondary Diagnosis Omission |

Chronic comorbidity left uncoded |

Lowers risk adjustment score, undercuts reimbursement |

|

Crosswalk Drift |

CPT/HCPCS mismatched to payer-specific policy |

Denials for “non-covered services” |

|

Template Dependency |

EHR auto-coding overrides provider documentation |

Results in systemic overcoding or duplication |

|

Non-Specific ICD-10 Usage |

Level 3 diagnosis used instead of level 5 specificity |

Leads to “medical necessity” denials |

|

Deleted Code Retention |

Old CPT/HCPCS codes active in the charge master |

Immediate payer rejection |

|

Procedure Duplication |

Both global and professional components are billed |

Causes overpayment clawbacks |

|

E/M Level Inflation |

Provider documentation doesn’t match the time-based requirement |

Fails payer post-payment reviews |

|

Incomplete Time Documentation |

Missing start/stop times on therapy or infusion codes |

Downgrades reimbursement |

Choosing between internal and external coding audits isn’t just a budgeting question — it’s a risk, accuracy, and accountability decision that impacts reimbursement, compliance exposure, and overall revenue integrity. Internal teams understand your workflow, but external auditors see patterns your team is too close to notice. This section breaks down the exact decision logic RCM leaders use to determine which model protects financial and compliance performance in 2025.

Internal audits often look cheaper on paper—until you calculate the hidden cost of undetected errors, payer takebacks, and documentation gaps that only surface during RAC or SMRC reviews.

External audits led by established medical coding audit companies introduce an unbiased layer of protection. They detect:

Rule of thumb:

If the potential penalties outweigh the cost of the audit, external reviews become an investment—not an expense.

Not every “coder who can audit” is a true auditor.

Executives often overlook three critical skill gaps:

Ability to interpret payer policy nuance (Medicare, Medicaid, commercial)

Pattern recognition across thousands of charts (internal teams rarely get this volume)

Competency in root-cause triage, not just error identification

External teams audit dozens of organizations, giving them rare benchmarking insight:

“What your practice thinks is normal may be a major red flag elsewhere.”

This difference alone can prevent denials and compliance exposure.

Some scenarios absolutely require a third-party audit—regardless of internal capabilities:

When revenue, compliance, or payer relationships are at stake, relying solely on your internal team can blindside you. External auditors bring the objectivity and scale needed to expose what internal coders cannot see.

Every strong audit starts with a disciplined, repeatable checklist. But most templates online are generic — they miss the financial pressure points, payer-driven rules, and documentation gaps that actually trigger denials. This coding audit checklist is designed the way top compliance officers, CDI leaders, and senior auditors structure their internal reviews: clear, actionable, and tied directly to reimbursement and compliance outcomes.

Use this checklist as your audit backbone—whether you’re reviewing 10 charts or 10,000.

What you verify:

Why this matters:

Most denials originate here — not in the codes themselves.

Check the following for every encounter:

Hidden value:

Correct sequencing and specificity raise clean claim rates dramatically.

Audit for:

This area triggers more payer audits than any other coding category.

Verify:

Why it matters:

One incorrect MCC can shift thousands of dollars per admission.

Confirm:

This protects against RAC, SMRC, and UPIC audits.

Check:

NCCI errors = instant payer red flags.

Audit for:

This is where most silent revenue leakage happens.

Verify:

Hidden mistake:

Charge capture misses often cost more than coding errors.

Coding audits become transformative when you stop thinking of them as “error checks” and start treating them as diagnostic tools. Real-world audits routinely show patterns, including hidden documentation gaps, pattern-based errors, and structural process inefficiencies that silently drain revenue. These anonymized instances demonstrate what happens inside high-performing audit programs and what providers may learn from them.

Scenario:

A multi-specialty surgical center saw an unexplained spike in payer denials tied to laparoscopic procedures. Claims were flagged for inconsistent CPT selection, despite surgeons believing their documentation was “complete.”

Audit Findings:

Root Cause Analysis:

The issue wasn’t coder skill — it was the documentation template itself.

Surgeons used a macro that didn’t force them to specify approach, laterality, or scope details. Coders had no way to resolve contradictions.

Outcome:

Key Lesson:

Most surgical coding errors begin in the OR, not in the coding department. A “perfect audit” can’t fix a flawed note.

Scenario:

A large outpatient practice noticed its clean claim rate falling from 92% to 78%. Finance teams assumed it was a payer system issue — but the problem was internal.

Audit Findings:

Root Cause Analysis:

The coders relied heavily on automated prompts inside the EHR, which suggested modifiers based on historical patterns rather than clinical need.

In short: the software became the auditor—and it was wrong.

Outcome:

Key Lesson:

Modifiers are the #1 revenue leakage point. Even small misapplications compound into six-figure losses.

Scenario:

A mid-sized hospital saw an abnormal drop in case-mix index (CMI). Leadership assumed patient acuity was genuinely decreasing—until a DRG-focused audit proved otherwise.

Audit Findings:

Root Cause Analysis:

Providers were documenting clinical impressions but not validating them with consistent clinical indicators.

Example: “AKI” written once without creatinine trends → coders removed it.

This wasn’t a coding problem — it was a clinical documentation integrity (CDI) gap.

Outcome:

Key Lesson:

DRG errors rarely stem from coding mistakes—they stem from missing, vague, or unvalidated documentation that auditors catch instantly, but frontline teams often overlook.

A medical coding audit has quietly shifted from a routine check to a survival strategy in 2025. Every payer is tighter, every rule is sharper, and every claim is scrutinized with data you never get to see. In this environment, the practices that stay financially steady are the ones that treat coding audits as a living system—something that protects them every single day, not just when something breaks.

Because small mistakes aren’t small anymore. A missed modifier, a vague note, an outdated CPT rule… one slip becomes hundreds, then thousands. That’s where revenue disappears, where compliance exposure creeps in, and where payer trust erodes.

A well-run audit closes those gaps early. It restores accuracy, strengthens documentation discipline, and gives your team something priceless: confidence that every claim you send out can withstand the toughest review.

“From 2024 to 2025, the biggest shift we’ve seen is payer algorithms detecting patterns, not isolated errors. The providers who thrive are the ones who proactively audit their coding, document their corrective actions, and integrate CDI with coder education. Those who don’t… eventually face denials, extrapolation, or worse. Precision is no longer optional—it’s the cost of survival.”

Ready to strengthen your accuracy and protect your revenue?

Talk to our certified coding auditors today—get clarity, confidence, and complete control over every claim you submit.

Q. What is a medical coding audit?

A medical coding audit is a review of medical records, coding accuracy, and documentation to confirm that claims are correct or not. The audit helps to reduce errors, denials, and compliance risks.

Q. Why is this service important?

Medical coding audit services provide complete expert reviews, helping healthcare providers to stay compliant, reduce denials, and improve revenue collection. They help healthcare practices to identify coding trends and areas for training.

Q. How medical coding and audit process improve revenue cycle management?

By detecting and identifying the coding errors early, the audits may prevent denials, reduce rework, and increase reimbursements. This may result in smoother revenue cycle management and regular cash flow.

Q. What are the benefits of outsourcing medical coding audit services?

Outsourcing the audit can help healthcare providers have access to expert auditors, result in compliance with the latest rules, reduce the workload of staff, and improve accuracy. It is mostly more cost-effective than depending only on internal audits.

Q. How does MedSole RCM help with medical coding audits?

At MedSole RCM, we provide customized medical coding audit services. Our team ensures compliance, improves accuracy, reduces denials, and enhances revenue recovery for healthcare practices.

Get quick highlights instantly

Recent Blogs

Posted Date: Jun 24, 2025

Posted Date: Jun 26, 2025

Posted Date: Jun 28, 2025

Posted Date: Jun 30, 2025

Posted Date: Jul 02, 2025

Posted Date: Jul 04, 2025

Posted Date: Jul 07, 2025

Posted Date: Jul 09, 2025

Posted Date: Jul 11, 2025

Posted Date: Jul 14, 2025

Posted Date: Jul 16, 2025

Posted Date: Jul 18, 2025

Posted Date: Jul 22, 2025

Posted Date: Jul 23, 2025

Posted Date: Jul 25, 2025

Posted Date: Jul 28, 2025

Posted Date: Aug 01, 2025

Posted Date: Aug 04, 2025

Posted Date: Aug 06, 2025

Posted Date: Aug 08, 2025

Posted Date: Aug 11, 2025

Posted Date: Aug 14, 2025

Posted Date: Aug 18, 2025

Posted Date: Aug 20, 2025

Posted Date: Aug 25, 2025

Posted Date: Aug 27, 2025

Posted Date: Aug 29, 2025

Posted Date: Sep 03, 2025

Posted Date: Sep 05, 2025

Posted Date: Sep 08, 2025

Posted Date: Sep 15, 2025

Posted Date: Sep 18, 2025

Posted Date: Sep 22, 2025

Posted Date: Sep 24, 2025

Posted Date: Sep 26, 2025

Posted Date: Sep 29, 2025

Posted Date: Oct 02, 2025

Posted Date: Oct 13, 2025

Posted Date: Oct 16, 2025

Posted Date: Oct 23, 2025

Posted Date: Oct 27, 2025

Posted Date: Oct 28, 2025

Posted Date: Oct 30, 2025

Posted Date: Oct 31, 2025

Posted Date: Nov 03, 2025

Posted Date: Nov 05, 2025

_11zon.webp)

Posted Date: Nov 11, 2025

Posted Date: Nov 14, 2025

Posted Date: Jan 05, 2026

.png)

Posted Date: Jan 02, 2026

Posted Date: Jan 06, 2026

Posted Date: Jan 07, 2026

Posted Date: Jan 08, 2026

Posted Date: Jan 15, 2026

Posted Date: Jan 13, 2026

Posted Date: Jan 21, 2026

Posted Date: Jan 22, 2026

Posted Date: Jan 26, 2026

Posted Date: Jan 27, 2026

Posted Date: Jan 28, 2026

_11zon.webp)

Posted Date: Jan 29, 2026

Posted Date: Jan 30, 2026

Posted Date: Feb 02, 2026

Posted Date: Feb 03, 2026

Posted Date: Feb 04, 2026

Posted Date: Feb 05, 2026

_11zon.webp)

Posted Date: Feb 06, 2026

Posted Date: Feb 09, 2026

Posted Date: Feb 10, 2026

_11zon.webp)

Posted Date: Feb 11, 2026

.webp)

Posted Date: Feb 12, 2026

Posted Date: Feb 13, 2026

Posted Date: Feb 17, 2026

Posted Date: Feb 18, 2026

Posted Date: Feb 19, 2026

Posted Date: Feb 20, 2026

Posted Date: Feb 23, 2026

Posted Date: Feb 25, 2026

Posted Date: Feb 26, 2026